Business Intelligence and Research

Integreon brings tech-enabled processes and a team of tenured researchers to consistently deliver the insights you need to grow and protect your business. Based on the way you like to work and your specific needs, results are packaged for ease of use and clarity.

Wide and specialized industry know-how yields actionable insights and a competitive edge

- 24/7 global support

- Scale up or down as needed

- Smooth and efficient delivery

Deep industry expertise

Integreon works with clients across a wide range of sectors and industries to collect data, identify and track KPIs, and generate valuable insights. Our clients range from law firms to investment banks and financial institutions to large, diversified conglomerates. Our team of sector specialists ensures that no industry-specific nuance is missed.

Customized partnership approach

A global delivery platform and expert resources enables Integreon to tailor solutions to meet client requirements, as well as quickly scale up or down as needed. Customized training programs and flexible staffing models allow clients to manage costs and utilize their own teams more efficiently.

Data driven performance

Robust management information systems ensure clients have real-time visibility into productivity and performance. Tailored SLA definition and reporting ensures the highest quality delivery.

A track record of success

Over 20+ years, Integreon has developed a highly structured approach to research and analytics. We deploy a robust training infrastructure along with a highly customizable workflow management tool and knowledge management systems to provide operational excellence.

Extensive ESG capabilities

Integreon has been at the forefront of ESG research and data collection providing a range of services from collecting data on emissions (including Scope 1, 2, and 3) to identifying and classifying controversial news reports. Integreon ESG coverage is currently comprised of 27,000+ companies.

Research and Analytics Services

Data Collection Services

- Case and legislation search and tracking

- KPI tracking for companies or industries

- Company, vendor and client profiles

- News monitoring

- Transaction screening

- ESG data including emissions, taxonomy and governance structures

- Tracking regulatory and legislative updates

- Website scrapping

- Data mining, cleansing and validation

Analytical Solutions

- End-to-end KYC solutions with a focus on identifying medium and low-risk clients

- Anti-Money Laundering (AML) screening solutions. Specialized services to discount false positives

- Sanctions screening for new or existing relationships covering a wide range of sanctions

- Custom built Know Your Vendor (KYV) profiles

- Competitive analysis using customized analytical frameworks and methodologies

- End-to-end market analysis including sizing, forecasting, outlining issues, challenges, and key players

- Benchmarking analysis for organizations, industries, products and services

- Best practices and case studies for a particular sector, industry, or service

- Research on specific ESG issues including quantifying exposure to high-risk industries or countries

- News-based ESG controversies reporting, identification and classification

Other Solutions

- Research support for RFPs and sales pitches

- Database/library services to collect and maintain information on companies’ governance structures and their performance

- Custom solutions such as assessment of new reporting frameworks or disclosures, identification of etc.

- Contact management

- Prospect list

- Content Management Services (CMS)

This is what true

partnership looks like

and transparency from start to finish. Thats why we treat

every client as our partner, providing regular updates,

reporting and analytics, all customized to your specific KPIs.

Flexible pricing models

Fast, efficient and high-quality presentation services for independent projects or ongoing support.

Hourly

Scale up or down as needed with access to our presentation design team billed at a flat hourly rate.

Benefits of Hourly

- Easily scale up or down

- Only pay for what you use

- 24/7 access to designers

Teamwork

Tackle high-volume work with seamless support from a dedicated team of presentation specialists.

Benefits of Teamwork

- Dedicated full time team

- Flexible pricing based on need

- Seamless service integration

Ready to do more?

Explore more business solutions

Learn More

Finding the Right Fit – Outsourcing Strategies for Financial Services Marketing Teams Infographic

For financial service organizations, outsourcing is not a one-size-fits-all proposition. One organization may outsource a single project, another may choose…

Integreon Partners with Turtl to Provide Dynamic Content Creation and Automation Capability for Creative Services Clients

December 9, 2020 – FARGO, ND and LONDON, UK – Integreon, a global managed services provider and leader in creative…

Keeping The Creative in Design Services with Murray Joslin

Murray Joslin, Senior Vice President of Business Enablement Services discusses the application of process and metrics to design services to…

Financial Services Marketing: Leveraging Outsourced Creative Services to Support Compliance

When it comes to creative services for financial institutions, people think of annual reports, industry reports heavy with charts and…

Chasing the Sun to Produce Impactful Global Presentation Graphics and Marketing Materials for Financial Services

Creating branded presentation graphics and marketing assets in the financial world can be nuanced, labor-intensive work. Often, international financial organisations…

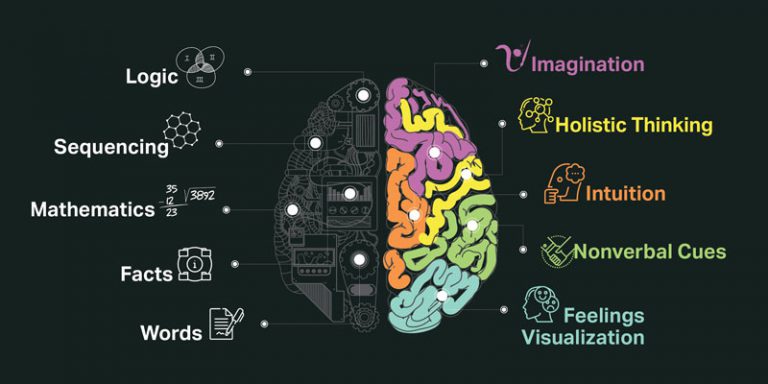

Right Brain + Left Brain = Visual Creativity Produced Daily Delivered On Time, On Brand and On Budget

The theory that people are primarily either left-brained (more analytical and methodical) or right-brained (more artistic or creative) has provoked…