KYC and AML Compliance

Strengthen compliance, reduce false positives, and move faster with KYC and AML support designed for global teams.

Our expertise in process design, partnerships in technology and highly skilled teams help you reduce costs, ensure efficiency and improve accuracy.

Smarter compliance, smoother operations

Financial crime regulations are complex and the volume of due diligence work continues to rise. Our trained compliance teams support your KYC, AML, KYV, and due diligence processes with consistent reviews, clear documentation, and fast turnaround times.

From screening new clients to monitoring transactions, we help you reduce risk while keeping operations smooth and compliant.

- Flexible, scalable support models

- Experienced reviewers and researchers

- Dedicated or project based teams

- 24/7 global support

KYC and AML services

We integrate into your existing KYC/AML processes and systems, enabling a seamless transition and smooth operations from day one.

KYC due diligence

Complete checks for politically exposed persons and for low- to medium-risk new or existing clients.

AML screening and review

Screening for anti-money-laundering risks, identifying unusual transactions, and discounting false positives.

Data sourcing

Source and identification of KYC data and documents for new and existing clients, customers and vendors.

Transaction monitoring

Monitoring and screening of alerts, activity and transaction patterns for error, false positives and corruption.

Case Study

Supporting one of the biggest crypto platforms with EDD and AML review.

A global cryptocurrency company needed to assess and manage risks while ensuring data accuracy and compliance, with Enhanced Due Diligence (EDD) and Anti-Money Laundering (AML) review for multiple languages and regions.

We completed daily manual reviews, real-time data cleansing, and supported teams in over 15 languages across three regions – all while reducing bottlenecks and improving regulatory compliance.

Over 99% accurate KYC data bank

Increased data accuracy and compliance

Multi-regional regulatory compliance

Decreased overall bottlenecks and fines

Ready to learn more?

Explore more solutions for businesses.

Learn More

Finding the Right Fit – Outsourcing Strategies for Financial Services Marketing Teams Infographic

For financial service organizations, outsourcing is not a one-size-fits-all proposition. One organization may outsource a single project, another may choose…

AllianceBernstein and Integreon Win Gold at Financial Communications Society’s 29th Annual “Star Gala”

Integreon recognized for build strategy of AllianceBernstein corporate website May 9, 2023 –– (NASHVILLE, Tenn. AND FARGO, N.D.) – AllianceBernstein…

Keeping The Creative in Design Services with Murray Joslin

Murray Joslin, Senior Vice President of Business Enablement Services discusses the application of process and metrics to design services to…

Financial Services Marketing: Leveraging Outsourced Creative Services to Support Compliance

When it comes to creative services for financial institutions, people think of annual reports, industry reports heavy with charts and…

Chasing the Sun to Produce Impactful Global Presentation Graphics and Marketing Materials for Financial Services

Creating branded presentation graphics and marketing assets in the financial world can be nuanced, labor-intensive work. Often, international financial organisations…

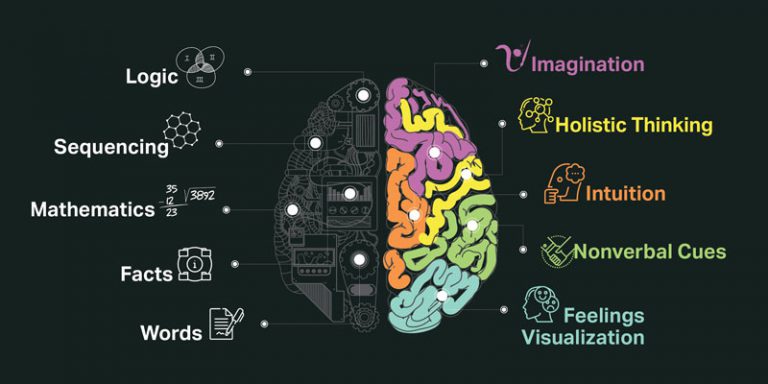

Right Brain + Left Brain = Visual Creativity Produced Daily Delivered On Time, On Brand and On Budget

The theory that people are primarily either left-brained (more analytical and methodical) or right-brained (more artistic or creative) has provoked…